In this section, you can customize your trading strategy according to your trading style. Whether you’re a swing trader or a scalper, you can trade in different styles with varying numbers of take profits or stop-loss adjustments. We’ve aimed to accommodate the preferences of the majority of our clients and implemented a highly flexible setting in this section.

In this section, you can customize your trading strategy according to your trading style. Whether you’re a swing trader or a scalper, you can trade in different styles with varying numbers of take profits or stop-loss adjustments. We’ve aimed to accommodate the preferences of the majority of our clients and implemented a highly flexible setting in this section.

Take Profit

You can select from 1 to 4 take profits depending on your trading style. Additionally, you can choose the percentage of take profit. In the right section, you can specify the percentage of your trade you want to lock in when the take profit is reached.The Qty, % should not exceed 100% in the selected take profits. For example, if you have chosen TP1 and TP2 for your trading, then the total percentage in these fields should not exceed 100% across both fields. If you make an error and specify more or less than 100% for the selected take profits, the backtesting system will automatically calculate and close the remainder of the trade, not exceeding 100% of the initial position.

While we have accounted for user error, we advise you to input the correct values in the selected fields.

While we have accounted for user error, we advise you to input the correct values in the selected fields.

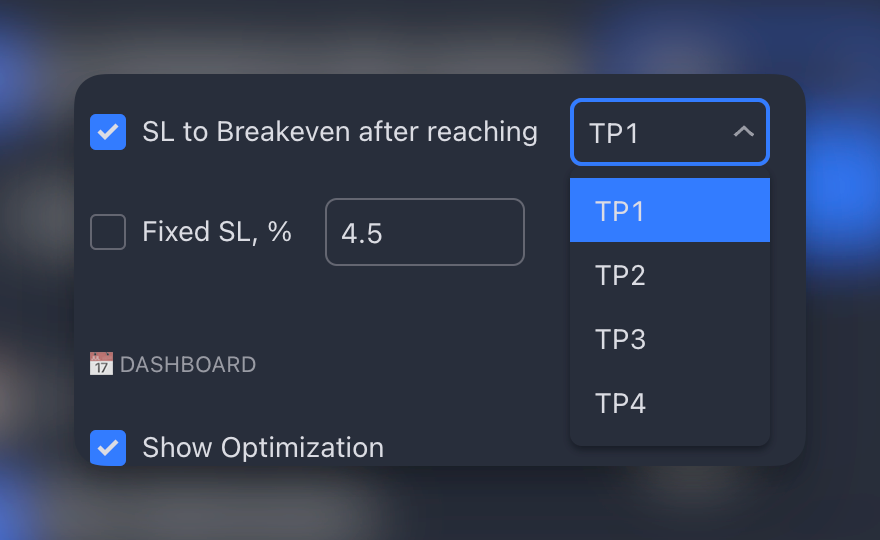

SL to Breakeven after reaching

In some cases, traders use a trailing stop when a certain take profit level is reached to maximize their profits. We have implemented this feature in optimizing the best strategy for your trading, and you can choose this option to see how it increases the percentage of successful trades in our Dashboard.

This is a very useful setting, and we recommend paying attention to it and testing different variations of your strategy.

In some cases, traders use a trailing stop when a certain take profit level is reached to maximize their profits. We have implemented this feature in optimizing the best strategy for your trading, and you can choose this option to see how it increases the percentage of successful trades in our Dashboard.

This is a very useful setting, and we recommend paying attention to it and testing different variations of your strategy.